Buyer Value Option BVO | Whitepaper

A well-structured Buyer Value Option (BVO) program is designed to attract and retain top talent by offering a unique home sale assistance benefit. This program allows employees who are relocating to sell their current home quickly and at market value, while reducing the stress and financial burden associated with relocation.

Through a BVO program, employees can sell their homes at a fair market value to an outside buyer, while employers provide a safety net in case the sale falls through. This enables employees to bypass the traditional home selling process, avoiding potential delays and uncertainties in the housing market.

Additionally, employees are often provided with professional assistance throughout the entire relocation process, including home marketing, staging (as needed), and closing support.

4 Benefits of Buyer Value Options (BVOs)

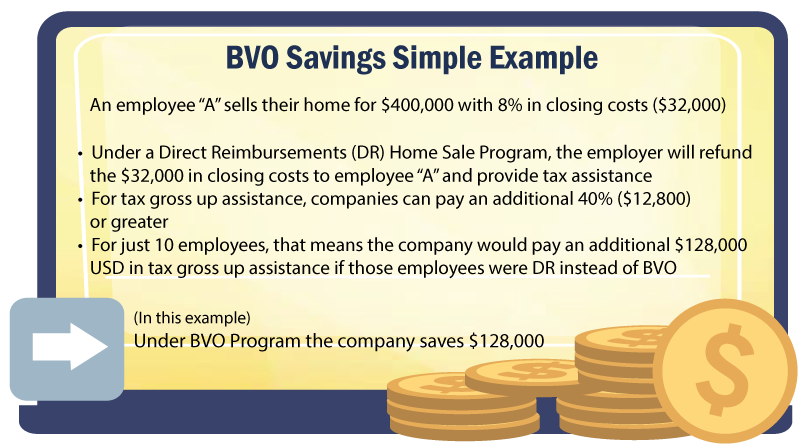

1) Tax Benefits that Lead to Cost Savings

BVOs provide tax benefits that lead to cost savings, especially compared to offering the Direct Reimbursement (DR) of home sale expenses. Since BVOs are considered two-part transaction with financial risk between you, your employee, and a 3rd party buyer, the IRS allows your organization to treat the closing costs as a business expense instead of taxable income to the employee. Therefore, your company can bypass gross up assistance for the employee.

Your organization still receives the same tax benefits as a Guaranteed Buyout (GBO often considered the richest benefit an employer could offer). However, with a BVO, your employee is required to find an outside buyer to establish the BVO value.

2) Competitive Relocation Offering

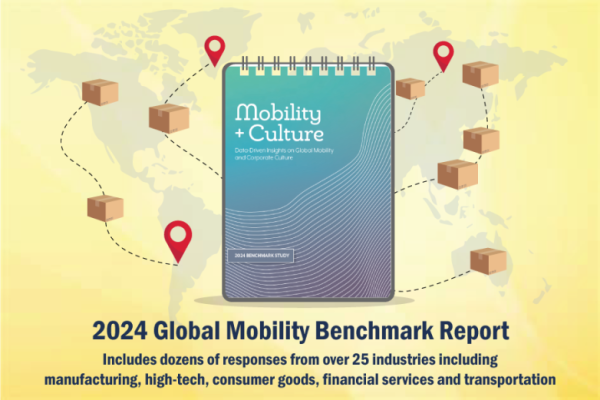

According to WHR’s 2024 Global Mobility Benchmark, a BVO program remains one

of the most competitive relocation offerings

- 60% of respondents offer home sale and/or purchase benefits.

- Of those,

- 59% offer BVOs to new hire non-executives

- 78% offer BVOs to new hire executives

- 67% offer BVOs to existing employee non-executives

- 74% offer BVOs to existing employee executives

- Of those,

3) Clear Understanding of Market Value

With every BVO, a Broker Market Analysis (BMA) is also completed by two qualified real estate agents.

This allows your organization, employee, and WHR to have a complete understanding of the home’s market value and risks

4) Faster Relocation for Employee

The BVO is a two-part transaction:

1 – Employee > WHR Global (for agreed price from outside buyer)

2 – WHR Global > to outside buyer

Employee is not required to attend closing, allowing them to relocate sooner

How do GBOs and BVOs Compare?

Guarantee Buyout Option (GBO) Overview

Buyer Value Option (BVO) Overview

- Under a Guarantee Buyout program, the Relocation Management Company (RMC) orders two home appraisals and then averages the two to determine a guaranteed offer, with a fixed acceptance period. If the employee cannot sell their home on their own, the employer takes the home into inventory. The employer must maintain it until the company can resell it. This carries potential risks and additional costs for an employer.

- While the guaranteed home sale process provides a safety net to employees for the disposition of their homes, it typically does not result in the maximization of the property sale price

- Strong home sale programs must be supplemented with pre-marketing activities and other incentives to assist the employee in selling their home.

In a Buyer Value Option program (BVO), the employee is responsible for listing their home for sale, with marketing assistance from the Relocation Management Company (RMC).

- In BVO program, the employee is responsible for listing their home for sale, with marketing assistance from the Relocation Management Company (RMC). The

employee must secure an outside buyer willing to purchase the home at a fair market value - The employee is funded their equity, if the contract is deemed valid, based on the outside offer amount. The RMC closes the sale with the buyer at a future date

- In a BVO home sale scenario, home appraisals are never ordered

- The Relocation Counselor (RC) will provide marketing assistance to the employee and support the selected agent in bringing in an outside buyer. The RC will assist in contract negotiations and work to obtain a bona fide offer for the employee

-

Once a bona fide offer is received by the employee, the RMC offers to buy the home from the employee at a price based on the outside sale price. The RMC will enter into a new listing agreement with the employee’s broker and proceed to close the transaction with the outside buyer while honoring all agreed terms and

conditions. Once the BVO is accepted by the employee, the RMC will be the owner of the property upon the later of the acquisition date or vacate date and will assume all burdens of ownership -

The RMC will pay off any outstanding mortgages on the acquisition date and any escrow refund will be sent directly by the mortgage holder to the transferring employee.

Summary

By offering a Buyer Value Option program, it demonstrates your company’s commitment to employee well-being and satisfaction.

By easing the transition for employees moving to new locations, companies can enhance employee morale, reduce turnover costs, and maintain productivity levels.

Furthermore, a BVO program can serve as a competitive advantage in attracting top talent, as it showcases a company’s dedication to supporting its workforce through major life changes. A BVO program is a win-win solution for employers and employees alike, fostering a positive corporate culture while streamlining the relocation process for valuable team members.

Ready to learn more about our move management services?

Estimación de los costes de reubicación en Estados Unidos

Interactive Repayment Agreement

Diseñador de la política de reubicación nacional

Comparación de referencias de reubicación

RFP - Solicitud de propuesta de reubicación Generador